21 February 2023

The Importance of Asking ‘How Did You Hear About Us?’

Key Learning Synopsis:

- 30% of referrals to care providers come through local reputation & recommendations from friends/family/healthcare professionals.

Understanding where care-seekers are finding out about your service is key to both maintaining and increasing care enquiry volumes.

We have analysed the past 6 months of referrals for our contact centre clients (10,000+ records) to see which channels care-seekers are using to get in touch. Clear channel attribution is achieved through our partners using tracked telephone numbers for their individual marketing channels. This is made possible through CareCall, a cloud-based call monitoring & analytics platform.

Alongside this, we have looked at the care seeker’s responses to the question ‘how did you hear about us?’ Knowing that a care-seeker found your telephone number through your website or Google is only part of the picture, it’s important to understand what prompted them to make an online search for your service.

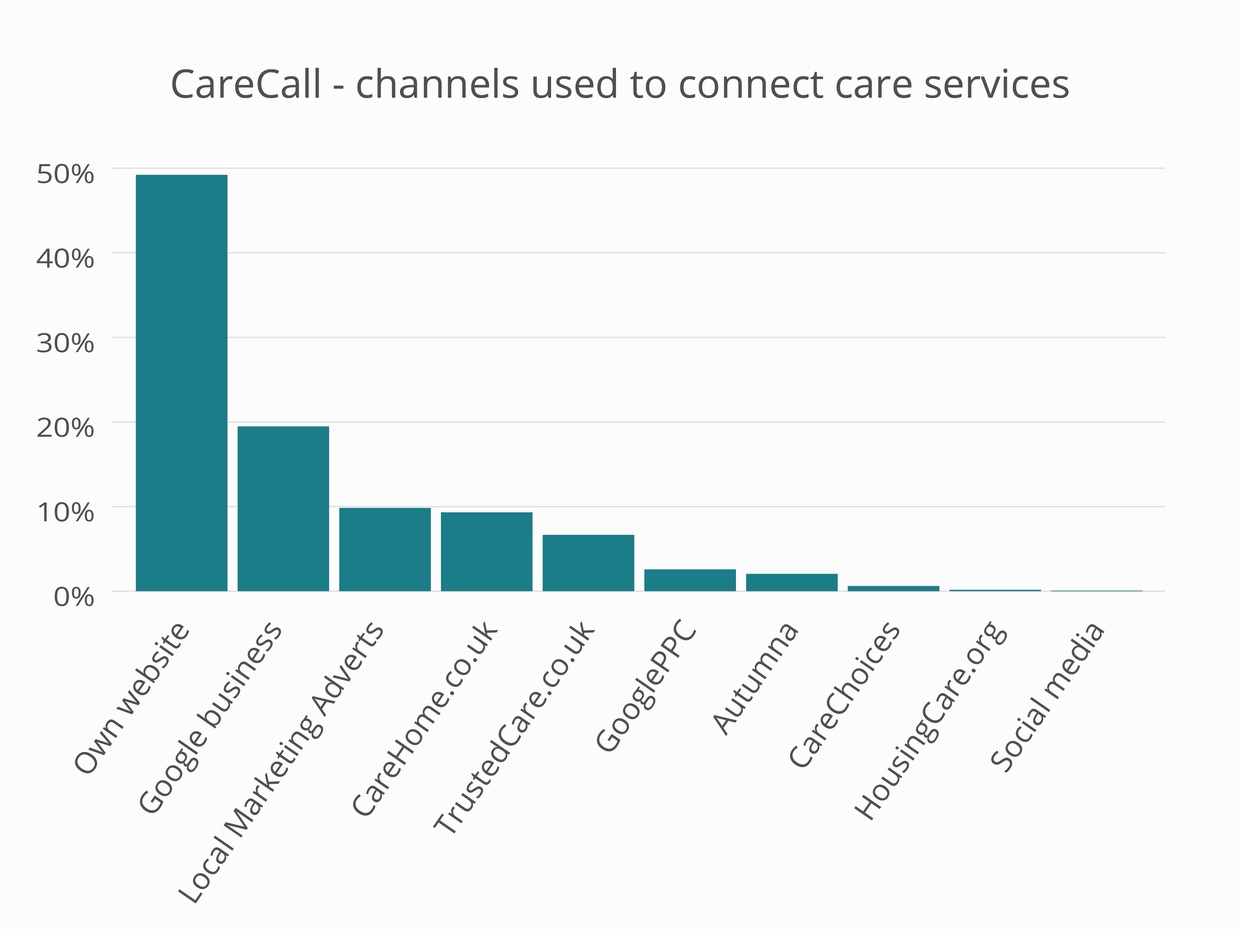

Channel Attribution - CareCall

| Channels called | % of referrals |

|---|---|

| Own Website | 49.22% |

| Google Business | 19.48% |

| Local Marketing Adverts | 9.84% |

| Carehome.co.uk | 9.32% |

| TrustedCare.co.uk | 6.66% |

| Google PPC | 2.58% |

| Autumna | 2.05% |

| CareChoices | 0.61% |

| HousingCare.org | 0.16% |

| Social Media | 0.07% |

Data from CareCall overwhelmingly suggests that care providers own website and Google Business are their biggest referral source.

Local Marketing, whether it be door-drops, leaflets, local radio and so on account for the third highest volume of enquiries to our partners (9.84%). Closely followed by Carehome.co.uk (9.84%) & TrustedCare.co.uk (6.66%) both offering online directory’s and care brokerage.

Then on a sliding scale accounting for just over 5% of total referrals is: Google Ads (2.58%), Autumna (2.05%), CareChoices (0.61%), HousingCare.org (0.16%) and Social media (0.07%).

Channel Attribution - How did you hear about us?

| How did you hear about us? | % of referrals |

|---|---|

| 25.8% | |

| Home Known Locally | 16.8% |

| Own Website | 16.2% |

| TrustedCare.co.uk | 7.5% |

| Recommended by Friend or Family | 12.5% |

| SW Referral | 6.7% |

| Carehome.co.uk | 4.6% |

| Healthcare Professional | 3.4% |

| Unable to Specify | 1.7% |

| Brochure/Local Advertising | 1.3% |

| Hospital Referral | Less than 1% |

| Less than 0.5% | |

| CQC Website | Less than 0.5% |

| GP Referral | Less than 0.5% |

| Broker/Directory | Less than 0.5% |

| Autumna | Less than 0.5% |

| CareChoices | Less than 0.5% |

| Homecare.co.uk | Less than 0.5% |

| Social Media | Less than 0.5% |

| Lottie | Less than 0.5% |

| HousingCare.org | Less than 0.5% |

The first thing of note is that there is double the amount of referral sources when you compare the responses of ‘how did you hear about us?’ to the CareCall data. However, you will see that these additional referral sources only account for a very small percentage of total referrals.

Perhaps the most interesting thing about these two datasets is the difference in referral volumes credited to Google & the providers own website:

| Channel | CareCall | How did you hear about us? | Difference |

|---|---|---|---|

| 19.48% | 25.8% | 6.32% | |

| Own website | 49.22% | 16.2% | 33.02% |

It is possible that the uplift in referrals being credited to Google when care-seekers are asked how they heard about the home is because Google is most people’s search engine of choice. Meaning the care-seeker will have found out about the service through Google but then go on to call the service through the telephone number listed either on the provider’s own website or through an online directory website.

Similarly, the huge difference in enquiry volumes attributed to ‘own website’ when datasets are compared is likely down to trends in consumer behaviour. Gone are the days of requiring a printed telephone directory to find the contact details of local businesses. Instead we look up the name of the service online & use a trusted source i.e. the provider’s own website, to find contact details.

So the question now is, what prompted the care-seeker to make an online search for your contact details? The ‘how did you hear about us’ data overwhelming points to the following 2 reasons:

- Home Known Locally (16.8%)

- Recommended by Friend or Family (12.5%)

When combined these two referral types account for 29.3% of total referrals. These insights support the importance of providers engaging with the local community, whether it be hosting coffee mornings or inviting the local primary school round for planned activities and so on. Additionally, recommendations come when people who have engaged with your service have had a positive experience. Meaning how you look after your residents, staff and even treat the local delivery driver is paramount to the number of people who will be recommending your service to friends and family.

The ‘how did you hear about us’ data also attributes just over 10% of total enquiry volumes to Social Workers and other local healthcare professionals. Meaning open lines of communication between care services and local healthcare teams about bed availability is very much recommended.

Get in touch to see how we can help you...

Get in touchWe work with some amazing companies

- Aria Care

- Caring Homes

- Barchester Healthcare

- Achieve Together

- Carebase

- Larchwood Care

- B&M Care

- Hamberley Care Homes

- MHA

- Gold Care Homes

- Home Instead

- Porthaven Care Homes

- Hallmark Care Homes

- Bristol Care Homes

- Elizabeth Finn Homes

- Abbey Healthcare

- Hythe Care

- Yorkare Homes

- Sfera Care

- Ashberry Care Homes

- Brendon Care

- Blackadder Care Homes

- RCH

- Adept Care Homes

- Athena Care Homes

- Wren Retirement Living

- Healthcare Homes

- Manucourt

- Anavo Group